Micro-Labs, Inc.

Comanche Trail sales@microlabs.com |

Micro-Labs, Inc.

Comanche Trail

Austin, Texas 78732, USAsales@microlabs.com

TradeStation Developers Since 1999

MoneyVolume ä Indicator

For TradeStation® 10 (and prior), 2000i, Pro, 6, 7, 8, SuperCharts 4

© Copyright 2000 Micro-Labs, Inc. All rights reserved

TABLE OF CONTENTS

Introduction..................................................................................................... 2

Installation........................................................................................................ 2

Applying the MoneyVolume Indicator......................................................... 3

Interpretting the MoneyVolume Indicator.................................................. 4

Example of MoneyVolume in Operation..................................................... 5

Advanced Parameter Settings....................................................................... 8

Using the MoneyVolume Function............................................................... 9

MoneyVolume Theory of Operation.......................................................... 11

Technical Support......................................................................................... 11

Limited Waranty, Disclaimers and Limitations of

Remedy.................... 12

License Agreement....................................................................................... 13

Trademark Acknowledgements.................................................................. 13

Rev

2.01

INTRODUCTION

The MoneyVolume Indicator for

Tradestation attempts to reveal buying/selling pressure and/or

accumulation/distribution in a security, which is not yet reflected in the

security price.

MoneyVolume is a technical

indicator calculated from both a security’s price and volume. It works equally

well in any time frame. It would usually be overlaid in the same window as the

security although it can be placed in a separate window. MoneyVolume is

interpreted by comparing MoneyVolume to price to see if a positive or negative

divergence has formed.

INSTALLATION

To transfer the MoneyVolume

indicator into your program, you will need to use the ELA (Easy Language

Archive) Transfer Utility that is built into the TradeStation Power Editor or

the SuperCharts Quick Editor. Once you have the MoneyVolume indicator in your

Program it will appear in the Function Library and you can apply it to charts

or use it in trading systems.

TradeStation

6, 7:

1. Insert

the “MoneyVolume Indicator” diskette into drive A:

2. Left

click on File, then left click on Import/Export Easylanguage…

3. Choose

the option: ‘Import EasyLanguage file (ELD, ELS or ELA) then click on NEXT>.

4. In the

‘File name:’ box type

5. ‘A:\moneyvol.els’

and Left click on NEXT>. A window should appear with a check mark by both

Function and Indicator. Left click on NEXT> again.

6. A

window should appear with a check mark by MoneyVolume Function, MoneyVolume

Indicator, and WeightedPrice Function. Left click on FINISH.

7. Left

click on OK twice to complete the transfer.

TradeStation

2000i:

1. Insert

the “MoneyVolume Indicator” diskette into drive A:

2. Go into

the EasyLanguage Power Editor. (press F12 from within ProSuite 2000i)

3. Left

click on FILE, then on IMPORT AND EXPORT.

4. Choose

the option: ‘Import EasyLanguage Archive or Storage File (ELA or ELS)’ then

click on NEXT>.

5. In the

‘Select the location of your EasyLanguage Archive file’ box type

‘A:\moneyvol.els’

and Left click on NEXT>. A window should appear with a check mark by both

Function and Indicator. Left click on NEXT> again.

6. A

window should appear with a check mark by MoneyVolume Function, MoneyVolume

Indicator, and WeightedPrice Function. Left click on FINISH.

7. The

transfer should complete and you may close the EasyLanguage Power Editor.

TradeStation

4:

1. Insert

the “MoneyVolume Indicator” diskette into drive A:

2. Go into

the EasyLanguage Power Editor.

3. Left

click on FILE, then on OPEN.

4. Click

on the Transfer button.

5. Choose

the option: 'Transfer Analysis Techniques FROM EasyLanguage Archive File

(.ELA)' then click OK.

6. In the

‘From’ box type ‘A:\moneyvol.els’ then click OK.

7. On the

next Menu, choose TRANSFER ALL, then click OK.

8. The

transfer should now be complete and you may close the EasyLanguage Power

Editor.

SuperCharts (4 and above only):

1. Insert

the “MoneyVolume Indicator” diskette into drive A:

2. Go into

the Quick Editor by choosing TOOLS, then OPTIONS, then Quick Editor.

3. Left

click on TRANSFER.

4. Choose

the option: 'Transfer Analysis Techniques FROM EasyLanguage Archive File

(.ELA)' then click OK.

5. In the

‘From’ box type ‘A:\moneyvol.els’ then click OK.

6. On the

next Menu, choose TRANSFER ALL, then click OK.

7. The

transfer should now be complete.

APPLYING THE MONEYVOLUME

INDICATOR

The installation process

described above only needs to be completed once. After installation, you are

ready to apply the MoneyVolume Indicator to a chart. The steps to do this are

as follows:

1.

Open up a chart and then Left click inside the chart

window where you want to add the indicator.

2.

On the menu, Left click on INSERT and then INDICATOR.

3.

Scroll down until you see MoneyVolume. Left click on

MoneyVolume to highlight it and then Left click on OK.

4.

Left click on the Style tab and set the Type to be Line

and then click OK.

5.

Left click on the Scaling tab and set Scale type to

Screen and then click OK. If you want MoneyVolume to overlay the price graph

(recommended) instead of being in a separate subgraph, then left click on

Properties and set Subgraph to One and click OK. Leave all Inputs set to their

default values for now. These values are explained in the section: Advanced

Parameter Settings.

6.

You should now see MoneyVolume plotted on your chart.

INTERPRETTING THE

MONEYVOLUME INDICATOR

The MoneyVolume Indicator for

Tradestation attempts to reveal buying/selling pressure and/or

accumulation/distribution in a security, which is not yet reflected in the

security price.

MoneyVolume is a technical indicator calculated from both a security’s price and volume. It works equally well in any time frame. It would usually be overlaid in the same window as the security although it can be placed in a separate window. MoneyVolume is interpreted by comparing MoneyVolume to price to see if a positive or negative divergence has formed. For example, if price surpasses its previous peak and the corresponding MoneyVolume indicator does NOT, it constitutes a negative divergence between price and MoneyVolume. The theory being that since the price peak is unconfirmed by the indicator, it should eventually result in the price pulling back. When considering these factors, it is important to note how reliably MoneyVolume worked in the past on a particular security and/or within the context of a particular time frame. If the indicator did not work reliably in the past, it stands to reason that is might not work in the future. It may also be helpful to look at MoneyVolume versus price on slightly different time frames. The more consistent the divergence is over several similar time frames, the more reliable the divergence would be considered. MoneyVolume would tend to be less indicative for very thinly traded issues which have only slight and/or sporadic volume in the time frame being observed.

Note that when MoneyVolume is shown on the same chart as price that the two lines do not always start in the same place on the left side of the screen and when the compression of the bars is changed it sometimes changes the position of the two lines relative to each other. This is because MoneyVolume and price have very different values and Tradestation has to scale them to fit the screen when putting them on the same graph. So when the compression is changed, different amounts of data are displayed on the screen and Tradestation scales them such that the visible data for each line is expanded to fill the screen. That is why you have to visually judge how MoneyVolume moves versus price, look for divergences, and not just look at the absolute position of the two on the same graph.

EXAMPLES OF MONEYVOLUME IN

OPERATION

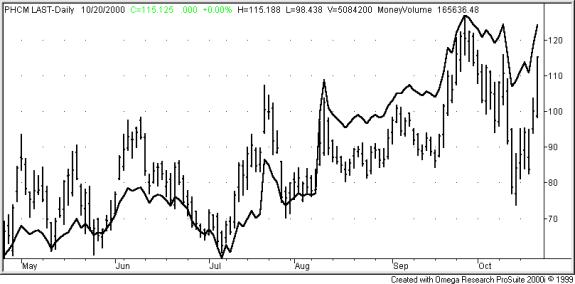

This is an example of a daily

chart where MoneyVolume gives us a number of clues as to the future direction

of the price. Note how the four rallies from May through July are unconfirmed

by a corresponding increase in MoneyVolume. In each case the rallies failed and

pulled back to the MoneyVolume line. However, in the late July pullback note

how MoneyVolume holds at the same height as the peak in June while price is

lower. This divergence is our first clue to the change in character about to

take place. Beginning with the August rally, note how MoneyVolume confirms the

rallies with new highs and relative strength. Now, instead of MoneyVolume

diverging with the rallies, it diverges with the pullbacks. Price drops much

more than MoneyVolume during the four pullbacks from late August through

October. In each case the stock price moves to catch up with the MoneyVolume

indicator.

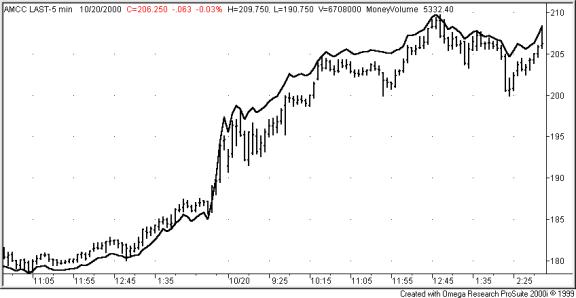

In this 5 minute chart of

Applied Materials, we can observe that MoneyVolume tracks the price fairly well

at the beginning of the chart which only tells us that we have no divergence

and price is moving in step with

MoneyVolume. Since we have a track record of

no divergence then when we do have a divergence, we can have more confidence

in the signal than for a stock where MoneyVolume and Price do not correspond as

well. Note that 90% of the time, MoneyVolume will tell us absolutely nothing

that we can’t already observe from the price. However, since we have so many

thousands of securities to select from, we are free to keep studying charts

until we find one in the 10% where we do see something.

In this chart the price starts

diverging from MoneyVolume at the beginning of the day on 10/20. MoneyVolume

does not fall as far as price and around 11:30 it makes a new high and starts

rising about 12:00 giving us a few minutes warning of the impending rally. Note

that at 12:45 price catches up to MoneyVolume, warning us that we probably need

to consider taking our profits or at least start setting tight stops. Note that what is more important than the

absolute values of MoneyVolume is the relationship of the behavior of

MoneyVolume versus price. So while MoneyVolume did make a new high at 12:45 which

would normally be a confirmation of the new high in price, we were suspicious

of the rally in price because it was the first time since 9:00 that the price

had caught up with MoneyVolume.

In this 5 minute chart of

Applied Micro Circuits we see MoneyVolume tracking price fairly closely up

until about 9:00 on 10/20. From that point on, MoneyVolume leads price higher,

confirming the new highs in price and holding when price pulls back.

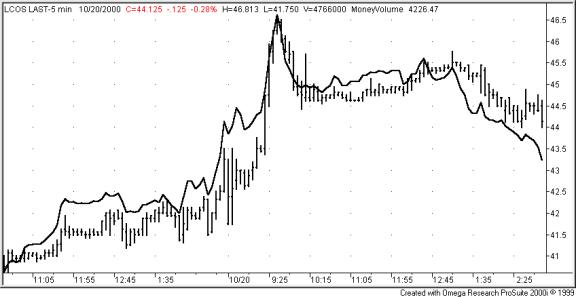

In this 5 minute chart of

Lycos, MoneyVolume shows a positive divergence at 11:55 and 2:00 of 10/19. On

10/20 at 9:00 we see another positive divergence of MoneyVolume preceding a

nice move to the upside in price. Also notice the negative divergence at 1:00

on 10/20 which appears in plenty of time to exit the position or go short prior

to the drop in price.

ADVANCED PARAMETER

SETTINGS

Since the interpretation of

MoneyVolume versus price divergences are somewhat subjective, we have developed

some more objective measures of interpreting MoneyVolume. These methods can be

used either in conjuction with the basic MoneyVolume versus price divengence

interpretation or as stand-alone Indicators. Several examples are given in the

next section, but the most basic way of looking at MoneyVolume is to determine

if it is currently above or below its own moving average.

By changing parameters in the

MoneyVolume Indicator, the MoneyVolume plot can be set to show one color when

it is above its moving average and a different color when it is below. The

Input parameters and their descriptions follow:

The MoneyVolume plot is shown

only in the one color which is set by the Format Indicator Color setting.

The MoneyVolume plot is drawn

with two colors as defined by the following parameters.

SimpleMovAvg=True

The color change is determined

by whether the MoneyVolume value is above or below the simple moving average of

MoneyVolume.

SimpleMovAvg=False

The color change is determined

by whether the MoneyVolume value is above or below the exponential moving

average of MoneyVolume.

AboveColor=Black, Blue, Cyan,

Green, Magenta, Red, Yellow, White, DarkBlue, DarkCyan, DarkGreen, DarkMagenta,

DarkRed, DarkBrown, Gray, LightGray

Determines the color the

MoneyVolume plot is when it is above or equal to its average.

BelowColor=Black, Blue, Cyan,

Green, Magenta, Red, Yellow, White, DarkBlue, DarkCyan, DarkGreen, DarkMagenta,

DarkRed, DarkBrown, Gray, LightGray

Determines the color the

MoneyVolume plot is when it is below its average.

USING THE MONEYVOLUME

FUNCTION

In addition to the MoneyVolume

Indicator your ELS file also includes the functions WeightedPrice and

MoneyVolume. WeightedPrice is used by the MoneyVolume Function and it simply

returns a value which weights the closing price the highest but also factors in

the price range for that bar.

The MoneyVolume Function can be

passed as an input to a number of traditional/commonly used Indictors instead

of Price. The theory is that MoneyVolume, by incorporating Volume and Price

might give a better signal/representation of what the market is doing than by

simply using Price alone. In the graph below, we have an example of doing this

with four common Indicators supplied with Tradestation:

The subgraphs and their

settings are described below:

ChangeColor=True, SimpleMovAvg=True, AboveColor=Cyan, BelowColor=Magenta, MovingAvgLen=12

Scaling set to “Screen”

Scaling set to “Screen”

Price=MoneyVolume, Length

(Simple Moving Average)=12, Displacement=0

Scaling set to “Same as Symbol”

ChangeColor=True, SimpleMovAvg=True, AboveColor=Cyan, BelowColor=Magenta, MovingAvgLen=12 (This should be set to the same number as Length Above)

Scaling set to “Same as Symbol”

Price=MoneyVolume, Length

(Simple Moving Average)=12, Displacement=0

Scaling set to “Same as Symbol”

ChangeColor=True, SimpleMovAvg=False, AboveColor=Cyan,

BelowColor=Magenta, MovingAvgLen=12 (This should be set to the same number as Length Above)

Scaling set to “Same as Symbol”

Price=MoneyVolume, Length=14,

OverSold=30, OverBought=70,

OverSColor=DarkRed,

OverBColor=DarkBlue

Scaling set to “User Defined”

Maximum=100, Minimum=0

Price=MoneyVolume,

FastLength=8, SlowLength=20, Displacement=0

Scaling set to “Same as Symbol”

MONEYVOLUME THEORY OF

OPERATION

MoneyVolume is similar to On

Balance Volume and Moneystream indicators in that it is a cumulative indicator

based on volume and price movement. On Balance Volume works by adding volume of

a particular bar if the price bar goes up and subtracting if it goes down.

However, it adds the total volume for that bar whether the price moves 1/16 or

1 point. It could be argued that the 1/16 point volume was either not relevant

or less relevant than the volume of the 1 point move. Moneystream works by

adding the volume of a particular bar multiplied by the price change of that

bar from the last bar. However, if price moves dramatically on lower than

normal volume, such as on a gap up or down or from the close of one day to the

open of the next, this introduces very large moves in Moneystream. It could be

argued that this movement of Moneystream did not really represent the

underlying consistent accumulation/distribution, which we are trying to

observe. MoneyVolume attempts to improve on both of these indicators by looking

both at the amount of price movement from one bar to the next as well as the

amount of volume/money, which caused that movement, as well as the relative

price volatility. It then adds or subtracts the weighted amount from the

previous MoneyVolume total. The intent is to show the buying/selling of the

security that is underlying the price movement but not apparently obvious

simply by looking at the security price and volume. The theory being that if

this underlying buying/selling of the security continues that the price will

follow.

The WeightedPrice Function is

also added to your list of available functions as it is needed by the

MoneyVolume Function. Instead of simply basing calculations on only the closing

price, this function considers the range of the price for that bar as well

although the value is weighted to give the most significance to the closing

price.

TECHNICAL SUPPORT

You may contact Micro-Labs

technical support by phone, fax, or email:

972-234-5842 9-5:30 M-F

972-234-5896 fax

LIMITED WARRANTY,

DISCLAIMERS

AND LIMITATIONS ON REMEDY

We warrant the physical

diskette and physical documentation furnished to you to be free of defects in

materials and workmanship for a period of

sixty (60) days from the date of purchase. Replacement of defective

disk(s) and documentation is your sole and exclusive remedy in the event of a

breach of warranty. In no event will we be liable for any damages to you or any

other person in excess of the lower of suggested list price or actual

consideration paid for the License to use the Software, regardless of any form

of claim. IN NO EVENT SHALL YOU HAVE ANY CLAIM FOR OR RIGHT TO RECOVER ANY

OTHER DAMAGES, INCLUDING BUT NOT LIMTED TO, LOSS OF PROFIT, INCIDENTAL OR

CONSEQUENTIAL DAMAGES OR OTHER SIMILAR CLAIMS, even if we have been

specifically advised of the possibility of such damages. The entire risk as to

the results and performance of the Software is assumed by you.

Except to the extent explicitly

provided above, the Software is provided “AS IS without warranty of any kind,

express or implied. THERE ARE NO OTHER WARRANTIES WHICH EXTEND BEYOND THE

DESCRIPTION ON THE FACE HEREOF.

Further, we do not warrant, guarantee, or make any representations

regarding the use, or the results of the use, of the Software in terms of

correctness, accuracy or otherwise. We specially disclaim all other warranties,

express or implied, including, but not limited to, and IMPLIED WARRANTY OF

MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. The diskettes(s),

information, and Software are acknowledged not to be “consumer products” within

the meaning of the 15 U.S.C. 2301 (1). Furthermore, you acknowledge that you

are not a “consumer” within the meaning of 15 U.S.C. 2031 (3).

The Software may include

specific and implied buy and sell recommendations pertaining to individual

stocks, options, indices, or other investment vehicles. It should not be

assumed that past performance is any guarantee of future results. Results

obtained from the use of these materials and information are not guaranteed to

be profitable. It should be understood that investing and speculating in the

financial markets involves a certain degree of risk and in some instances may

result in either partial or total loss of one’s capital. The information in these

materials has been obtained from sources which are believed to be reliable, but

cannot be guaranteed as to its accuracy or completeness, whether supplied as

written materials, magnetically or electronically by any means.

LICENSE AGREEMENT

1.

GRANT

OF LICENSE. For the consideration you have paid for the Software, you are

granted a non-exclusive, non-transferable license to possess, use and display

the Software on a single computer unit at a single location at any one time.

2. OWNERSHIP

OF SOFTWARE. Except for your licensed right to possess, use and display the

software under the terms of this License, all title to and rights in the

Software remain with Micro-Labs, Inc.

3. RESTRICTIONS

ON COPYING, REPRODUCTION. By paying a license fee and taking possession of our

Software, you acknowledge that both are copyrighted under and therefore

protected by Federal Law. You Agree not to infringe or contribute to the

infringement of our copyright by copying, reproducing, enhancing, or creating

derivatives of our Software.

4. MODIFICATIONS.

This License may be modified by Micro-Labs, Inc. in conjunction with any

enhancement of the Software.

TRADEMARK ACKNOWLEDGEMENTS

MoneyVolume and Micro-Labs are trademarks of Micro-Labs, Inc.

SuperCharts, TradeStation and the Omega Research Solution Provider

Logo are a trademark of Omega Research, Inc.

All other brand and product names are trademarks or registered

trademarks of their respective

companies

The MoneyVolume Indicator is priced at $70.

Contacts: sales@microlabs.com, support@microlabs.com

Ordering Information: Products can be ordered directly from us by email, fax, or phone. We accept most credit cards through PayPal by clicking on the PayPal icon below. We also accept COD (within the US only plus $7 fee), wire transfer ($20 additional), Western Union, or you can send us a check drawn on a US bank in US$ in advance. Add $6.90 for UPS ground shipping, handling, and insurance for one graphics board shipped within the continental United States. Contact sales with your address for the amount to add if your requirements are different. Let us know if we can be of further assistance.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

(c) 2009 Micro-Labs, Inc. Last updated 6/18/09 |